IRS Updates and Notices

The IRS Moves to Electronic-Only

Processing for Faster Filing

Due to staffing shortages and processing backlogs, the IRS has announced that paper filings may face significant delays. The IRS requires businesses to file Form 720 and Form 8849 electronically through IRS-authorized e-file providers to ensure quicker acknowledgment and processing by the IRS.

Executive Order 14247: Modernizing

Federal Payment Systems

Executive Order 14247 aims to modernize federal payment systems by transitioning from paper refund checks to electronic payments. In line with this initiative, the IRS is reducing its reliance on paper submissions and refunds to enhance security, efficiency, and processing speed.

About QuickFile720

QuickFile720 is developed by Excise Tax experts to simplify the complex federal excise tax filing process. Our goal is to make it more straightforward and efficient for businesses and individuals alike. We aim to save you time and reduce stress in filing your taxes.

As an IRS-authorized 720 e-file provider, QuickFile720 ensures that all your filings are secure, accurate, and compliant with IRS regulations. Our platform offers a trusted and reliable way to handle federal excise taxes. With IRS approval, you can count on the integrity of our services.

QuickFile720 is also SOC2 certified, meaning we meet the highest standards of security, privacy, and data protection. This certification guarantees that your sensitive information is kept safe using industry-leading security protocols. You can trust us with your data, knowing we prioritize its safety.

All Form 720 Taxes and Form 720 Schedule C Claims

under one roof - QuickFile720

Quick EFile 720

What is Federal Excise Tax?

Federal excise tax is an indirect tax imposed by the U.S. government on specific goods, services, and activities, such as fuel, airline travel, indoor tanning, trucks, and other popular categories like PCORI, International remittance etc., Businesses that deal in these taxable items are responsible for reporting and paying these taxes to the IRS.

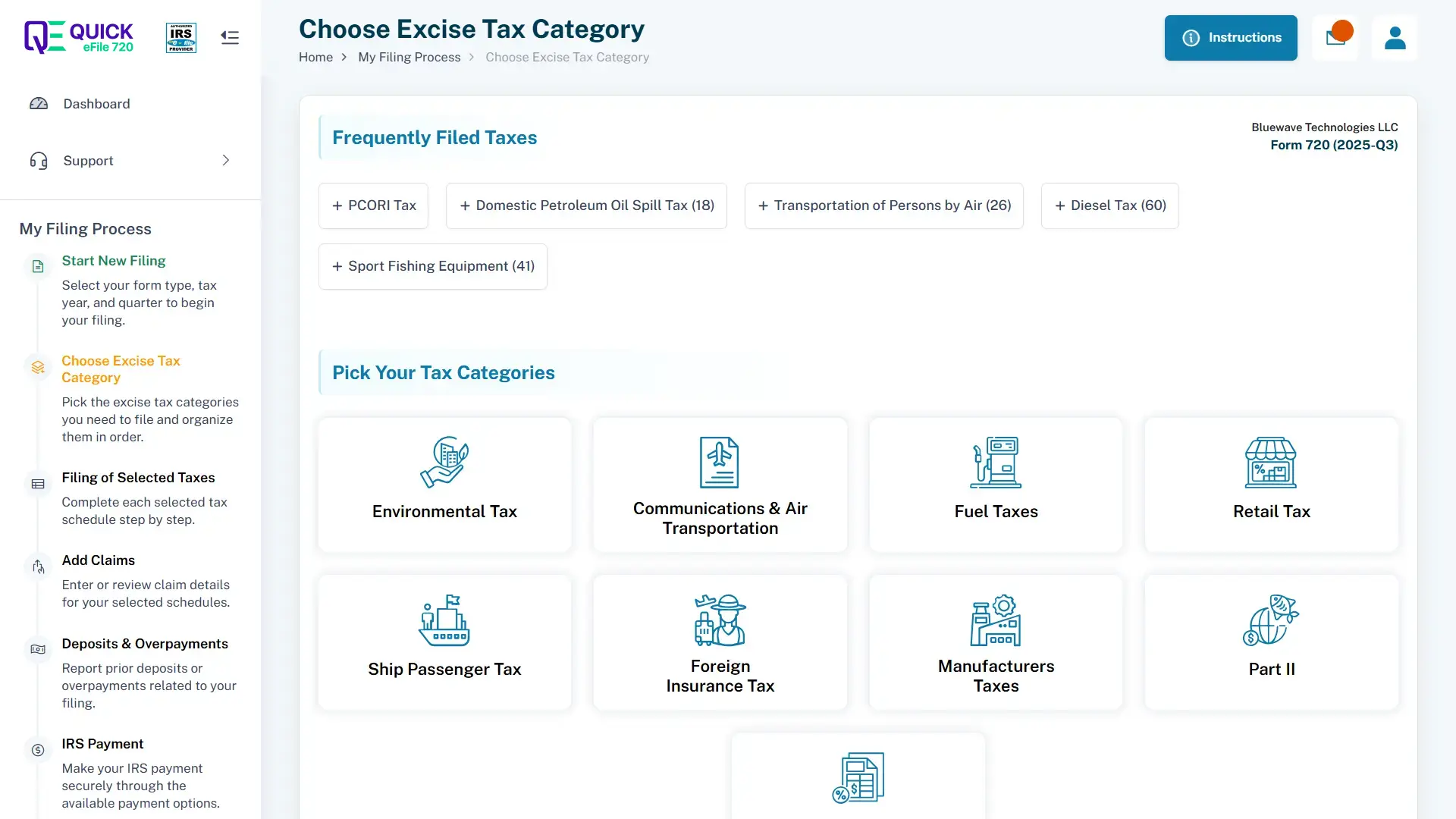

What is IRS Form 720?

IRS Form 720, officially titled the Quarterly Federal Excise Tax Return, is the tax form used by businesses and certain taxpayers to report and pay federal excise taxes for each calendar quarter. It must be filed quarterly with the IRS to report liability for excise taxes on applicable goods and services.

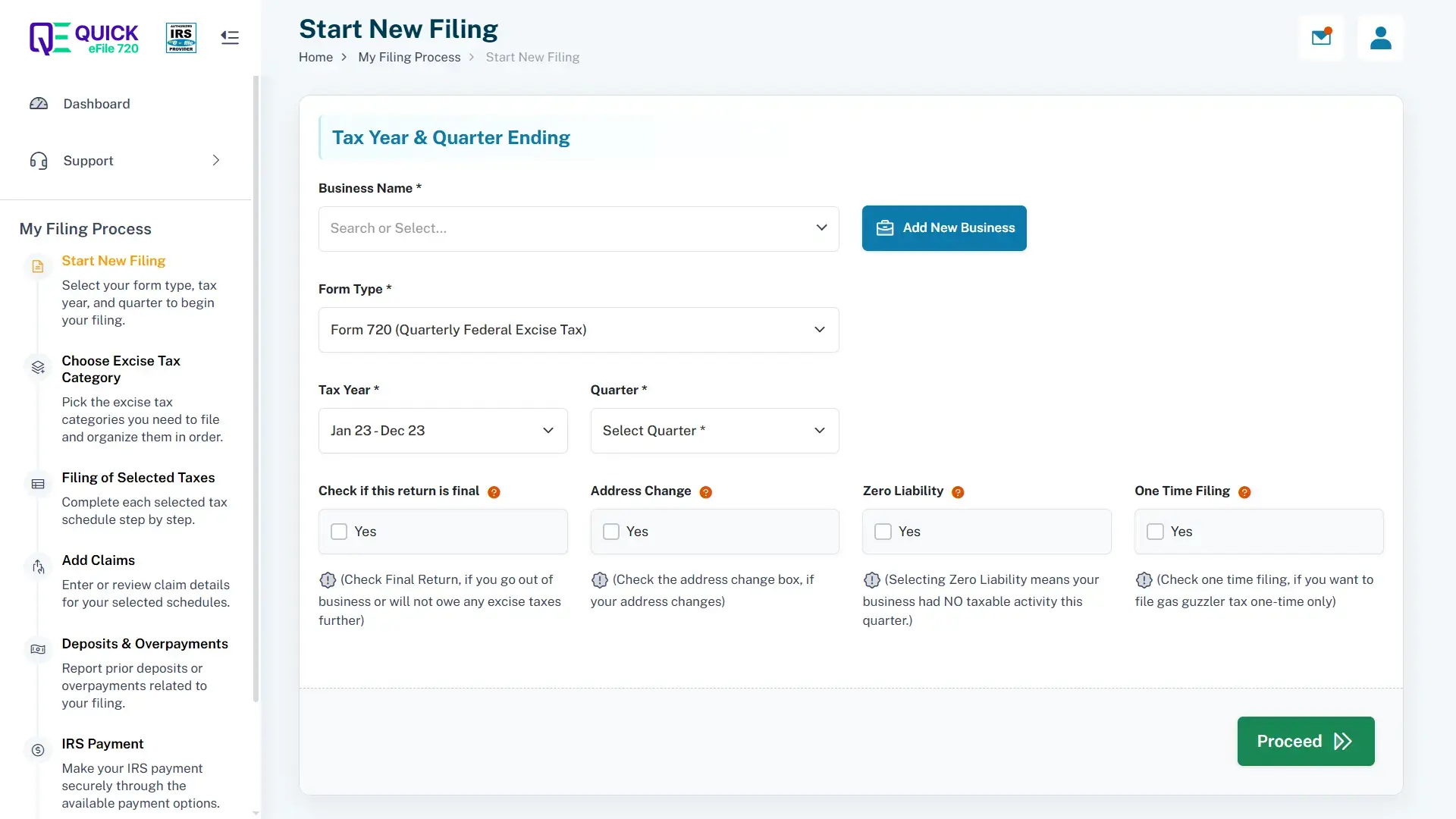

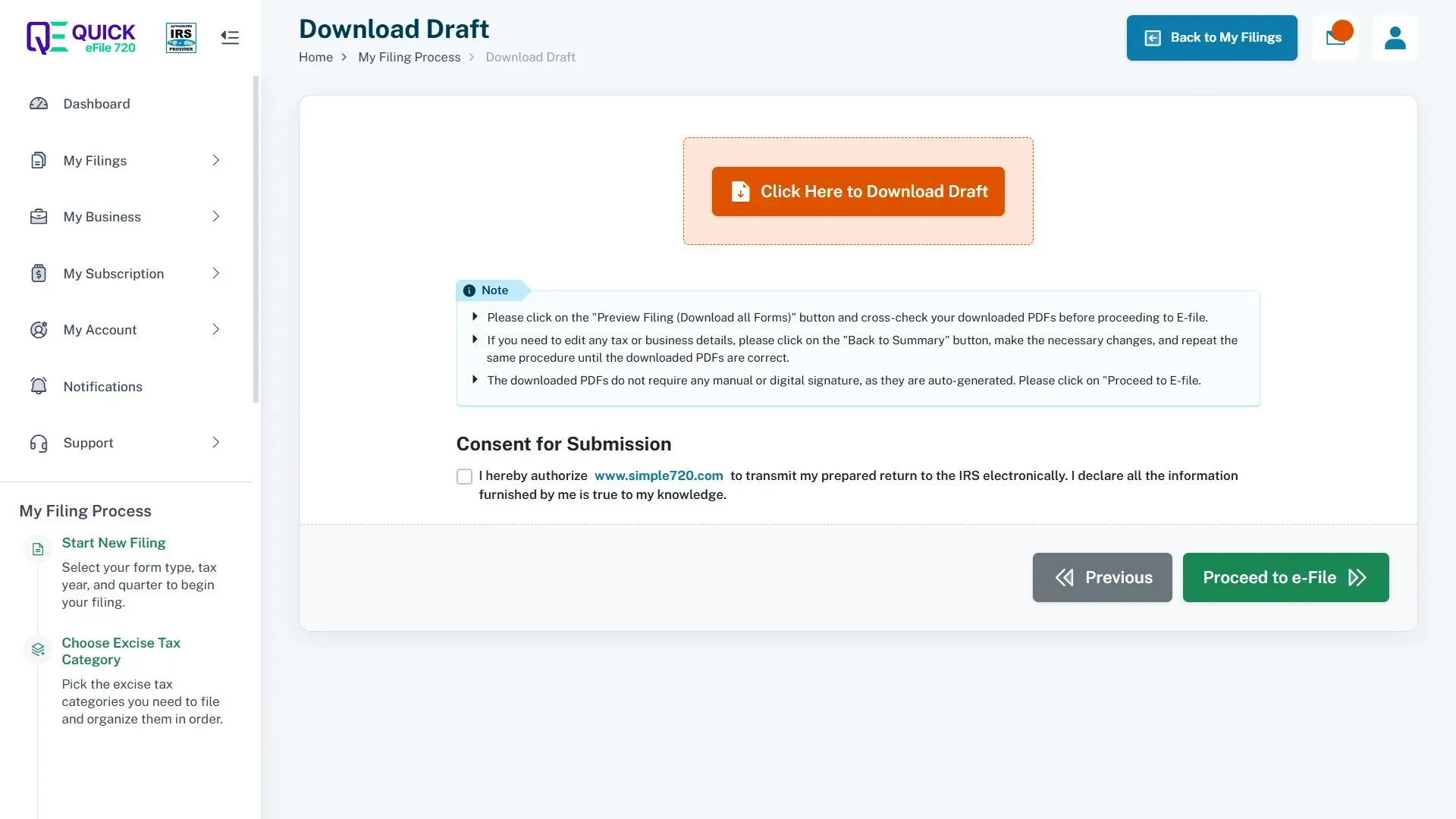

File Form 720 in 5 Easy Steps

Type

and Enter Details

Amount

Payment

Happy Clients

QuickFile720 made our federal excise tax filing effortless.

Fast, secure and hassle free - we'll never file manually again!

Thanks to QuickFile720, we save time and avoid errors.

Form 720 Filing has never been easier or more reliable!

Want to learn more?

Want to know how our online portal works for Form 720 filing?

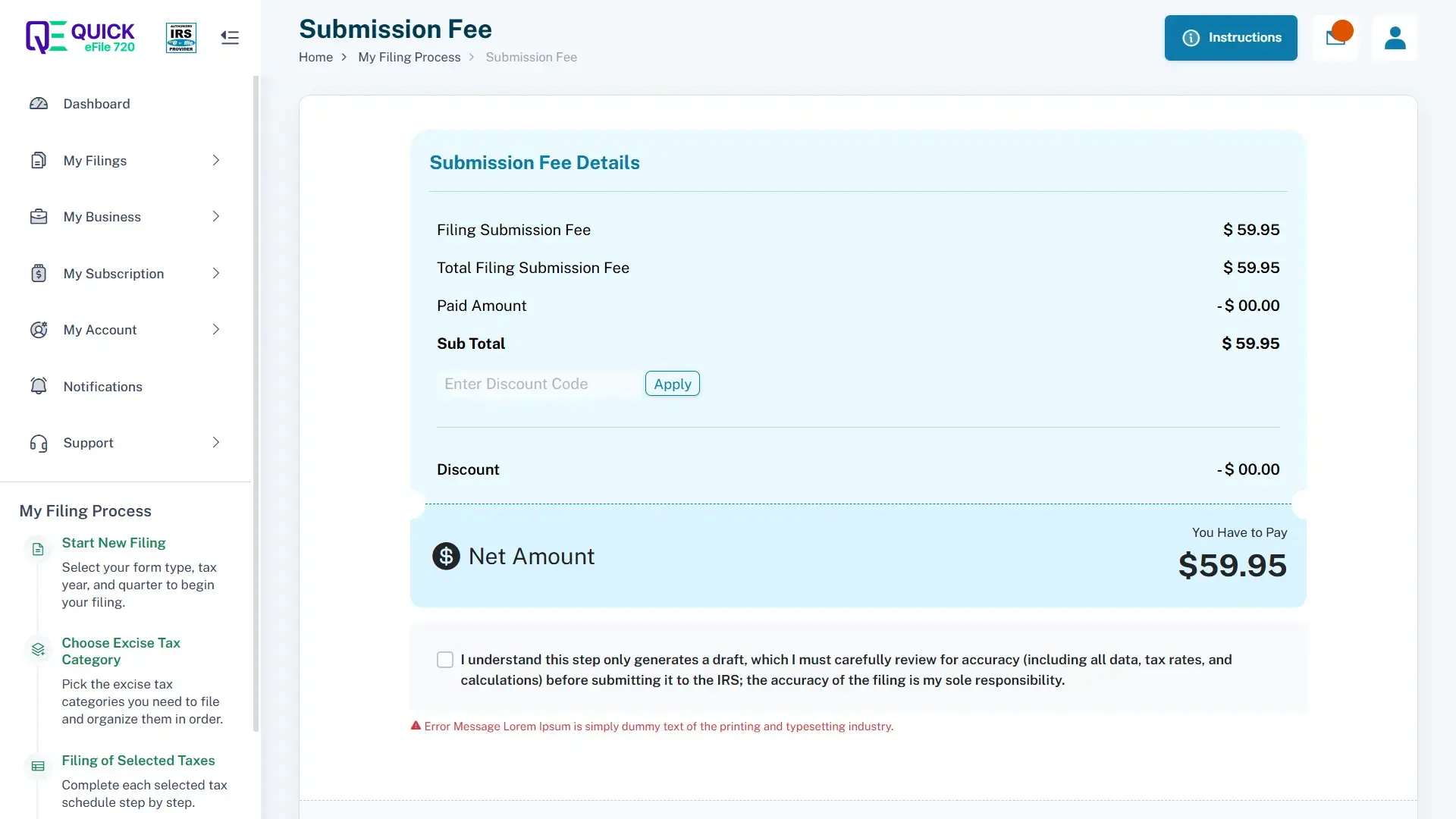

Our secure IRS-authorized e-filing system makes Form 720 submission simple, accurate, and hassle-free.

Frequently Asked Questions

Complete your quarterly Form 720

excise returns in minutes.

No software downloads. Just a few clicks and you're done.

File Form 720 Online